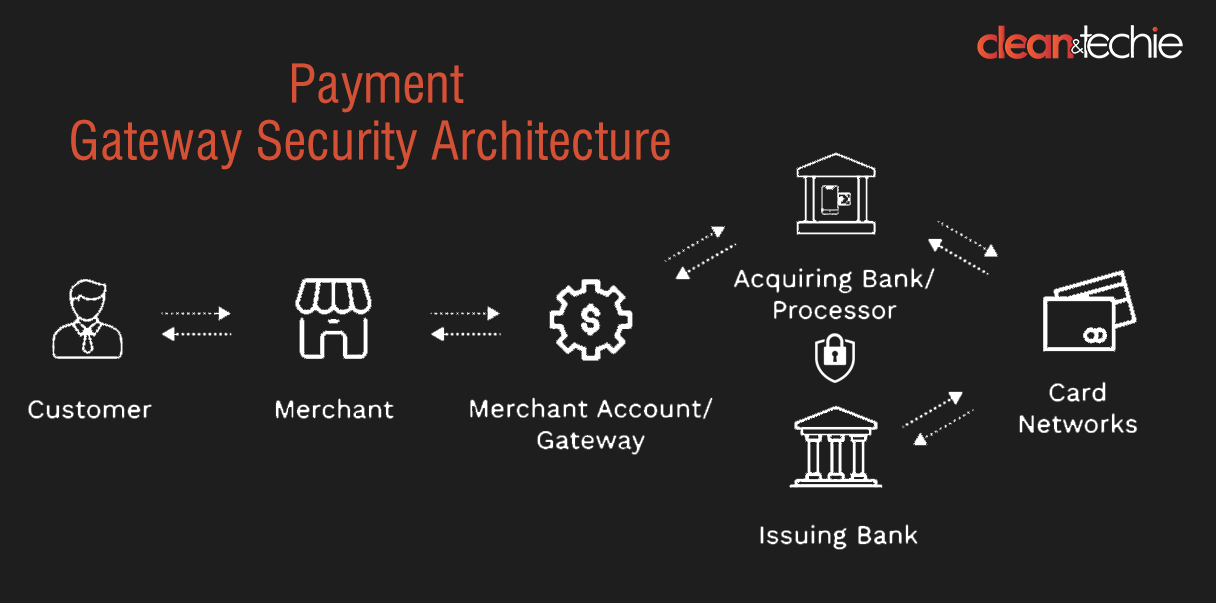

A payment gateway: The connecting link between a customer and an e-commerce merchant.

Payment gateway security architecture is what makes online transactions safe and reliable. In today’s online world of online shopping, payment gateways act as the trusty sheriff, as fraud costs are projected to hit $35 billion globally by 2024.

These payment gateways make sure that transaction processing is secured for both merchants and customers. This security doesn’t happen by chance. Payment gateways rely on a multilayered payment gateway security architecture to keep financial information safe from hackers and intruders.

Let’s take a look at the integral components of the payment gateway security architecture.

Initiation

When you buy something online, you reach the checkout page to enter your card details, like card number, expiration date, and that special code on the back (CVV). This is where the initiation happens of the transaction process. These details don’t go directly to the merchant’s website. In fact, it is sent to a special service called a payment gateway. It acts like a middleman, securely handling your card details and making sure everything is on the up and up.

Encryption

A payment gateway is responsible for encrypting the payment information. Once you enter your card details, it is secured and transferred in a secured manner. It’s like turning it into secret code! This special code travels safely through the tunnel to the merchant’s processor, where it’s unscrambled to check if your payment is good. This way, your sensitive card information stays protected during its online journey.

Authorization Request

The online journey towards the issuer bank and back with a response is handled by the payment gateway system. The network then acts like a switchboard, figuring out where to send the message next. It looks for your card service provider and routes it to your bank (the issuing bank that gave you the card). Now, your bank receives the message and checks if you have enough money and if the card is valid. If everything is good, they send an “approved” message back through the whole chain. This lets the merchant know you can pay, and you can complete your purchase!

Transaction Approval/Declination

Once the data is securely sent to your merchant’s processor, it further travels to your bank for approval. Now, your bank is like a checkpoint. They decrypt and check the received data. This is necessary to make sure the account has enough money, and the card is valid. If everything’s fine, the bank sends an affirmative response back through the whole system. This lets the merchant know you can pay, and you can finally buy that product you saw online. But if there’s not enough money or the card isn’t valid, the bank sends a “transaction denied” message, and the purchase gets declined.

Confirmation

If your bank authorizes the transaction (meaning your card is valid and has enough money), the information travels back through the system, from your bank back to the card network. The processor, like a messenger, finally delivers the message to the payment gateway. The gateway, which is the bridge, takes note of the “transaction approval” message and sends it to the merchant’s website. This is the ‘go ahead’ for the store; they know you can pay for your purchase. So, the website shows you a confirmation message, letting you know everything went smoothly and the purchase was completed successfully.

Settlement

Even after the transaction is completed, the store doesn’t get the money right away. Instead, at the end of the day, they group all the approved purchases together like a big box. This box gets sent to their processor, like a delivery person. The processor takes the box and sends it on separate trips to each card network (Visa, Mastercard, etc.). The networks then act like mail carriers, delivering each purchase’s information to the correct bank (the one that issued your card). Finally, the bank says, “Okay this purchase is good” and moves the money from your account to a special account for the store’s bank (called the acquirer). This acquirer is like the store’s own bank, and it deposits the money into the store’s account, so they get their payment! It might take a day or two, but eventually, the money from your purchase reaches the store.

Conclusion

This whole process, from the moment you enter your card details to when the money reaches the store, might seem complex, but it actually happens in just a few seconds. Imagine swiping your card in a store – online payments are just as fast, thanks to this amazing behind-the-scenes system. This is a big reason why online shopping is so convenient these days. You can browse from the comfort of your couch, click “buy,” and know within seconds that your purchase is confirmed. Pretty impressive, right? So next time you shop online, take a moment to appreciate the smooth flow of information that makes it all possible!